What is a credit card?

The credit card represents a loan, permanently available to the client. The maximum amount that can be obtained with the card is called by the banks – the credit limit. This decreases as the money is used and is reintegrated with reimbursement.

The card can be used by the customer as he wishes. It can make various payments at the stores that accept the cards or simply withdraw cash from ATMs.

By its nature, however, the credit card is a product intended to facilitate payments to merchants and, less, to use for the purpose of withdrawing cash from ATMs.

The differentiation is evident obviously. We just have to consider the higher net level of commissions when withdrawing cash compared to debit cards. In addition, most banks charge interest on the amounts withdrawn in cash from the credit cards, from the moment of the operation.

In the beginning, the use of credit cards issued by the Romanian credit institutions was limited, in most cases, to the national territory. At present, however, almost all credit cards issued under the Visa, MasterCard or American Express logo can be used abroad.

Credit cards are generally issued in lei. However, there are banks where cardholders can opt for currency cards. Such an option is recommended for those who travel frequently, because the use of a card issued in foreign currency will be accompanied by a conversion fee of 2% of the transaction value.

My card was not accepted for payment. Why?

There are several situations in which your card can be refused payment. The most common situation is the lack of funds on the card. You must fill the card with funds, or ask the issuing bank to increase the current credit limit.

Cards appearing on the ‘black list’, ie those that are reported as lost, stolen or blocked by the holder, will not be accepted for payment.

Before shopping online you need to make sure you have the card activated for online use. Otherwise, it will not be accepted and you should contact the issuing bank and request to activate this service.

Also, a transaction can be rejected if the card issuer could not be contacted and the “stand-in” limits defined by it do not allow eCommerce transactions or limit the maximum value of the transaction. In this case, the support offered by the issuing bank should be called to the phone numbers registered on the card. They are the only ones able to provide real information about the duration of the failure and the causes of the incident.

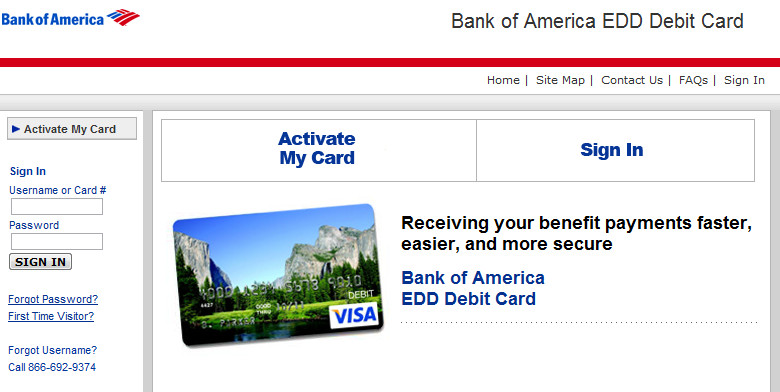

Bank of America has built up a custom answer for its dedicated clients which include stacking benefits onto a Debit Card. Presently as opposed to pausing and looking out for direct store you can approach your advantages readily available stacked on to a preloaded card with the advantages from joblessness or handicap at any minute. Nowadays with such a large number of individuals in a situation where they need quick access to their advantages this is a perfect answer for a typical issue. Be that as it may, before you may utilize your EDD Debit card you should initially initiate it.

Go to www.bankofamerica.com/eddcard .

Click Activate my Card.

After this step proceed and put in the subtleties of contact data which will be important to guarantee that you have full access to your card and after that you will be enacted.

In contrast to a prepaid card, cash can be reloaded onto the card each month to guarantee that the majority of the bills and essential needs are secured. Notwithstanding the capacity to be preloaded they additionally take into consideration advantages to arrive at the client days before they could ever do as such in a conventional situation. Ordinarily this is an entire a few days before the client could ever get them in another situation. Thus presently EDD Debit cards are turning into the favored technique for decision for conveying advantages to a holding up client since without those advantages it is beyond the realm of imagination to expect to have the option to proceed in their present jobs. Clients get themselves frequently needing advantages and looking out for the postal administration and customary methods for conveyance can now and again be a bit excessively long.

Be that as it may, with the new conceivable outcomes which are empowered here with electronic use and spending there will never be a postponement in advantages, nor is there a deferral in the measure of time which is important to push ahead with the buy of anything the client may need or need.